Nigeria is seeking $1.5bn aid from the World Bank to tackle the severe dollar shortage contributing to the decline of the naira.

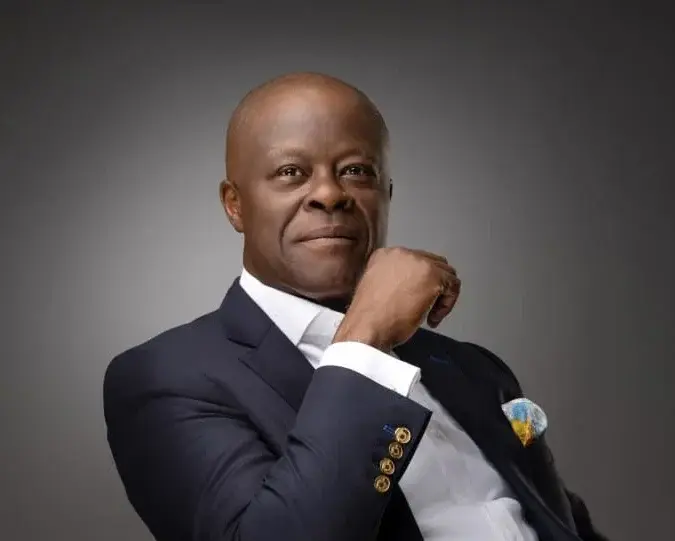

“We’re hoping to get $1bn or $1.5bn from the World Bank” for budgetary support, Finance Minister, Wale Edun said Wednesday to Bloomberg.

According to the minister, Africa’s largest economy may also issue a Eurobond in late 2024, adding that with the current economic reforms, the country deserves support.

Eurobonds, denominated in foreign currencies, offer Nigeria a mechanism to navigate its financial landscape amidst challenging economic conditions.

The minister said, “It is a matter of discussion at the moment, but we think we will get the support because we are continuing with our reforms.”

Nigeria has issued Eurobonds in the past to raise debt to fund infrastructure and boost its economy

In 2022, Nigeria entered the international debt markets with a $1.25bn Eurobond issuance, marking its eighth venture into this financial arena, according to the Debt Management Office.

Subsequently, in the following year, the country redeemed a $500m Eurobond issued in July 2013 as part of a dual-tranche of $1bn, held for a tenor of ten years at a coupon of 6.375 per cent per annum.

During a press conference in October 2023, at the World Bank/International Monetary Fund Annual meeting in Marrakech, Morocco, the minister mentioned that the $1.5bn World Bank loan would be coming with zero interest rate.

Nigeria is currently battling with about N87tn debt, which the International Monetary Fund said was “manageable,” but noted that the interest payment was high for the country.

The minister said the new World Bank loan would be used to finance development, disclosing that the facility would be disbursed to Nigeria very soon.

He said, “On the talks with the World Bank on $1.5bn budget support, that is correct. The World Bank is the number one multilateral development bank helping developing countries or funding developing countries, projects programs, and sectors.

“It has free money through the International Development Association. It is for the poorer countries and right now, I think we qualify as one of the countries that can borrow from the normal window of the World Bank funding, but also some concessionary IDA funding; and that means that effectively, the interest rate will be zero.”

Nigeria has nearly $7bn in forex forwards that have matured, a major concern for investors, but the Central Bank of Nigeria has promised to pay up to boost confidence in the foreign exchange market.

But the apex bank recently disbursed $2bn to settle a backlog of outstanding foreign exchange forwards, emphasizing its commitment to enhancing liquidity and stability in the foreign exchange market.

In the face of mounting economic challenges, Nigeria grapples with a budget deficit fueled by factors including soaring fuel subsidy costs, burdensome debt servicing, and restrained public spending.

The 2024 fiscal year budget stands at a hefty N28.7tn, accompanied by a deficit of N9.18tn, equivalent to 3.88 per cent of the nation’s Gross Domestic Product.

President Bola Tinubu emphasised that the current deficit is an improvement from the N13.78tn recorded in 2023, representing 6.11 per cent of GDP.

To address the deficit, President Tinubu outlined a multifaceted financing approach. This includes new borrowings totaling N7.83tn, N298.49bn sourced from privatisation proceeds, and a N1.05tn drawdown on multilateral and bilateral loans earmarked for specific development projects.

Africa’s largest economy is also confronted with persistent dollar shortages, increased demand for dollars, and speculative activities that have exerted pressure on the naira, leading to its devaluation.

The shortage of dollars has widened the gap between the official exchange rate and the parallel market rate, further impacting the street value of the naira.

Naira on Wednesday fell to a record low of N1,320 per dollar following strong demand on the parallel market.

The domestic currency depreciated 4.72 per cent to close at N878.57 to a dollar at the close of business, based on data from NAFEM where forex is officially traded.

Credit: punchng.com

Leave a reply