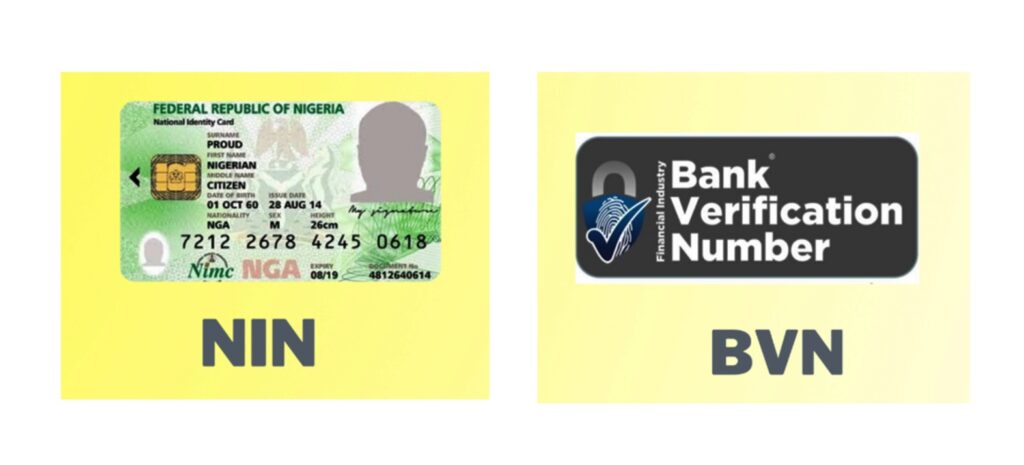

World United Consumer Organisation, WUCO, has urged the Central Bank of Nigeria, CBN, to create remote access methods and alternative procedures for Nigerians in diaspora to be able to link their National Identity Number, NIN, and Bank Verification Number, BVN.

The global advocacy group which is dedicated to ensuring equitable access to essential services for consumers worldwide, equally urged the apex bank to reconsider its deadline for NIN/BVN linkage.

In a statement it issued on Tuesday, WUCO, through its President and human rights lawyer, Mr. Clement Osuya, stressed that though the CBN’s directive may be well intentioned, “it fails to consider the unique challenges Nigerians living abroad face.”

It decried that the apex bank did not make adequate provisions for those with remote access to their funds.

“Additionally, it does not offer any viable means for Nigerians living abroad to link and obtain their NIN,” WUCO added.

It will be recalled that the CBN had instructed all bank customers to link their NIN and BVN to their bank accounts.

The apex bank equally directed that banks should place restrictions on all Tier 1 bank accounts without BVN.

In its statement, WUCO noted that the directive placed a burden on Nigerians in diaspora as it mandates them to visit enrollment centres for biometric capture at NIN centres, physically.

It further noted that those in diaspora could not comply with the NIN registration deadline owing to COVID-19 pandemic and the resulting travel restrictions.

“This presents substantial logistical and financial challenges for diaspora Nigerians. Compliance with the NIN registration deadline has been made exceedingly difficult due to

“It is imperative to highlight that over 70 million accounts are at risk of being blocked if they are not linked with the NIN.

“Yet, there are no explicit provisions for remote linkage or alternative processes for Nigerians in the diaspora. This lack of consideration for the diverse circumstances of Nigerian bank customers, especially those residing outside the country, is deeply concerning.

“The World United Consumer Organization demands an immediate review of the prevailing directive and calls upon the CBN to introduce robust and accessible means for Nigerians outside the country who do not have a National Identification Number (NIN) to link their NIN to their accounts.

“The Central Bank must prioritise the concerns of Nigerians in the diaspora to ensure fair and inclusive compliance with this directive, as the diaspora’s contribution to capital importation into Nigeria is critical to the country’s financial inflows, which have significantly impacted the Nigerian economy.

“We urge the CBN to collaborate with financial institutions to create remote access methods and alternative procedures for diaspora Nigerians to link their NIN.

“These measures would ease the logistical and economic burden on Nigerians living abroad while ensuring the integrity of the national identification linkage directive.

“In conclusion, regulatory authorities must acknowledge Nigerians’ varied needs and challenges, both within and outside the country.

“These considerations must be incorporated into implementing critical directives.

“The World United Consumer Organization remains dedicated to advocating for the just and impartial treatment of Nigerian customers in the financial sector, both within and outside the country and to incorporating these considerations into implementing critical directives.

“The World United Consumer Organization remains committed to advocating for the fair and equitable treatment of all Nigerian customers in the financial sector,” the statement further read

Leave a reply